Recent wildfires in Southern California have left many homeowners facing the difficult decision of what to do with fire-damaged properties. Whether your home was insured or uninsured, navigating the aftermath of such a disaster can be overwhelming. For many, selling to a cash buyer offers a quick, practical solution. Here’s what you need to know to make an informed decision.

Why Cash Buyers Can be Ideal for Fire-Damaged Properties

1. They Purchase As-Is: Cash buyers specialize in purchasing homes in their current condition, including those with extensive fire damage. This means you can avoid costly repairs and the stress of rebuilding.

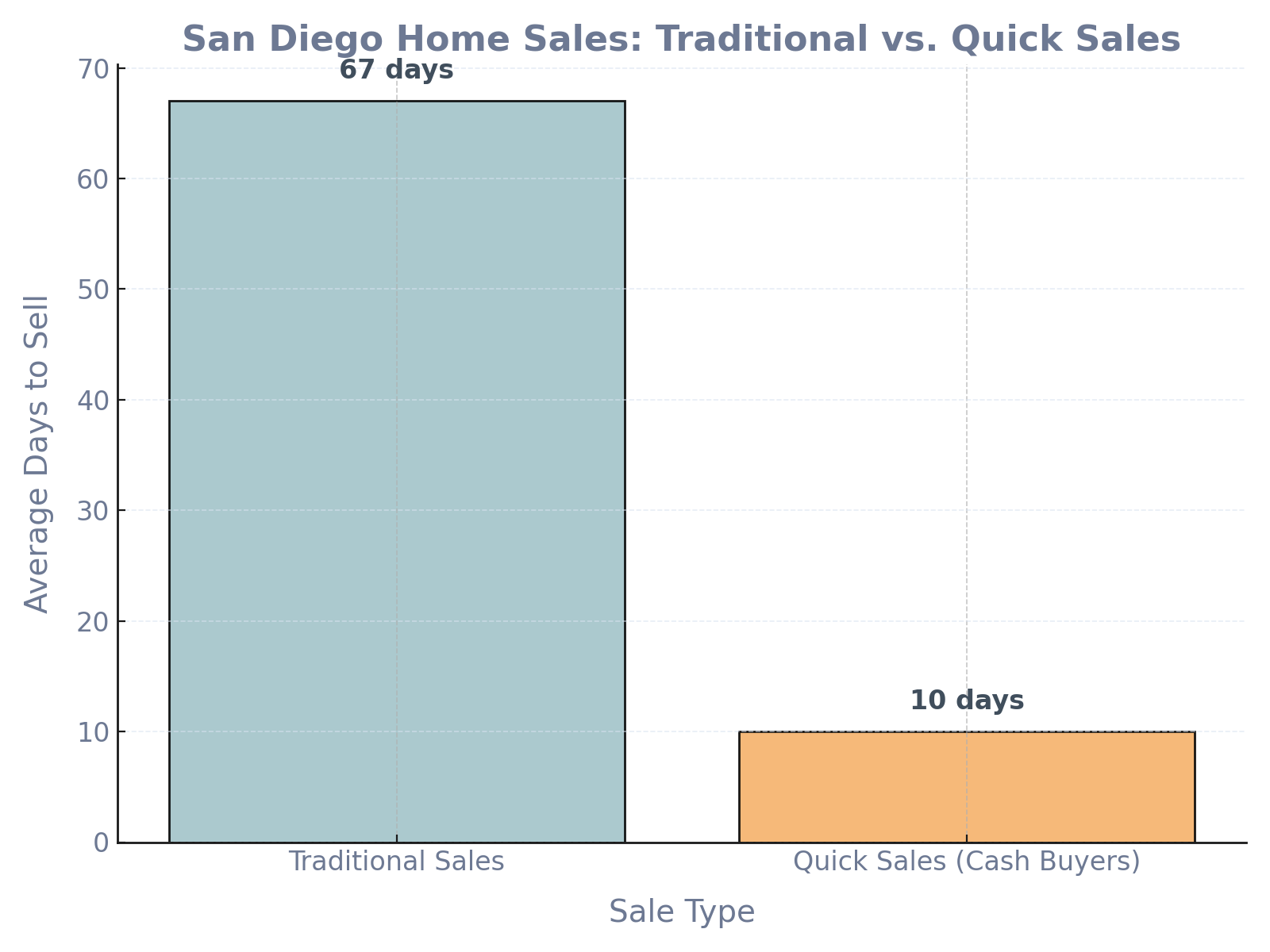

2. Fast Transactions: Unlike traditional sales channels, which can take months, cash buyers can close within 7-14 days. This rapid timeline helps homeowners move forward quickly.

👉Need cash fast for your fire-damaged property? Get an offer within 24 hours—contact us now!

3. No Financing Risks: Cash buyers eliminate the uncertainty of financing falling through, ensuring a smoother transaction.

4. Relieve Financial Burden: For uninsured homeowners, the financial toll of rebuilding can be insurmountable. Selling as-is provides immediate relief and cash in hand.

Insured vs. Uninsured Properties: Key Considerations

For Insured Properties:

- Work With Your Insurance First: Before selling, ensure you’ve filed all necessary claims and received your payout. Some insurance policies may cover partial rebuilding costs or total losses.

- Negotiating After an Insurance Settlement: Selling to a cash buyer post-settlement can provide a clean slate without additional complications.

For Uninsured Properties:

- Avoid Rebuilding Costs: Without insurance, rebuilding can be financially devastating. Selling to a cash buyer avoids this burden.

- Salvage What You Can: While the home may be a total loss, land value can still be significant—cash buyers will often make competitive offers based on the property’s potential.

👉Explore your options with trusted experts. Whether you rebuild or sell as-is, we’re here to guide you every step of the way.

What Happens When an Entire Community Burns Down?

Wildfires that devastate entire neighborhoods, like Pacific Palisades, create unique challenges for homeowners and the broader community. Here are some key considerations:

1. Community-Wide Infrastructure Loss: When fires destroy not just homes but schools, utilities, and local businesses, the ability to rebuild the community is often delayed. This can make it difficult for homeowners to stay in the area, even if they plan to rebuild their property.

2. Emotional and Financial Strain: Homeowners often face the dual burden of losing their home and the sense of community that came with it. This emotional toll, coupled with the financial challenges of rebuilding, can push many to consider selling as-is and relocating to a more stable area.

3. Increased Demand for Cash Buyers: Cash buyers play a critical role in community-wide recovery efforts. By purchasing multiple properties quickly, they help inject much-needed resources into affected neighborhoods, paving the way for redevelopment.

4. Success Stories in Rebuilding: Some communities, like Paradise, CA, have are successfully rebuilding after devastating fires. These success stories often involve partnerships between homeowners, cash buyers, and developers to transform the area into a vibrant, renewed neighborhood.

Quantifying the Value of a Burned-Down Property

Even if a home is a total loss, the property retains value. Here’s how it breaks down:

1. Land Value:

- Location is the biggest factor. Properties in high-demand areas like Los Angeles often have high land values.

- Example: A 7,500 sq ft lot in Los Angeles might sell for $200–$300 per sq ft, giving it a land value of $1,500,000–$2,250,000.

2. Salvage Value:

- Salvageable materials like metal, concrete foundations, or utility hookups can add value.

- Example: Salvageable materials might reduce rebuilding costs by $10,000, which adds to the property’s value.

3. Insurance Settlement (If Applicable):

- Replacement cost value (RCV) or actual cash value (ACV) from insurance can significantly offset losses.

- Example: If your insurance payout is $490,000 after deductibles, this adds to the total value.

4. Total Valuation Formula:

Example Total Value Calculation:

- Land Value: $1,750,000.

- Salvage Value: $10,000.

- Insurance Payout: $490,000.

- Total Value: $2,250,000.

5. Fire-Damaged Property Discount: Cash buyers typically offer 60-80% of the property’s post-damage value due to redevelopment risks.

- Example Offer: If the total value is $2,250,000, a cash buyer might offer 70%, or $1,575,000.

Impact of Wildfires

Rebuilding Costs: The recent wildfires have caused extensive damage, with insured property losses in Los Angeles County estimated to reach up to $40 billion. Rebuilding costs for individual homes vary, with estimates around $947,000 in Pacific Palisades and $262,000 in Altadena. (Source: New York Post)

Insurance Challenges: Many homeowners are underinsured, and there is a growing reluctance among insurers to provide coverage in fire-prone areas. This has led to a moratorium on insurance for homes within a 35-mile radius of the fire line, complicating the rebuilding process. (Source: New York Post)

New Legal Protections for Homeowners: In January 2025, Governor Gavin Newsom issued an executive order to protect homeowners from predatory real estate practices in fire-affected areas. The order temporarily prohibits unsolicited and undervalued offers for properties in regions like Los Angeles, including Malibu and Pacific Palisades. Violations can result in fines or imprisonment. Homeowners should ensure offers meet fair market value and consult real estate professionals or legal advisors for guidance. (Source: gov.ca.gov)

Considerations for Homeowners:

- Rebuilding: While rebuilding offers the potential to restore property value, it entails significant costs, time, and potential insurance hurdles. The high demand for construction services may also lead to delays and increased expenses.

- Selling As-Is: Selling the property in its current condition to cash buyers provides immediate financial relief and eliminates the burdens associated with rebuilding. However, offers may be lower due to the property’s condition.

👉Don’t wait—get a no-obligation offer today and move forward with confidence. Contact our team now for a fast, stress-free sale!

Case Study: Lessons from the Cedar Fire

The Cedar Fire, one of the largest wildfires in California history, devastated parts of San Diego County in 2003, destroying over 2,800 structures, including homes in Alpine, Ramona, and Scripps Ranch. This event provides valuable insights into the challenges homeowners face after a wildfire:

Rebuilding Challenges:

- Insurance Shortfalls: Many homeowners discovered they were underinsured, leaving them unable to cover the full costs of rebuilding.

- Delays in Rebuilding: High demand for contractors and materials caused significant delays, with some families waiting years to return to their homes.

- Increased Costs: Construction costs surged due to supply shortages, often exceeding insurance payouts.

Selling As-Is Outcomes:

- Immediate Relief: Some homeowners sold their fire-damaged properties to cash buyers, using the funds to relocate or downsize.

- Lower Valuations: Sellers typically received offers based on land value alone, as the homes were beyond repair.

- Quick Sales: Transactions were often completed within weeks, allowing families to move forward quickly without the financial and emotional toll of rebuilding.

Key Takeaways for Modern Homeowners:

- Insurance Gaps Are Common: Regularly review and update your insurance policies to reflect current rebuilding costs.

- Cash Buyers Provide a Viable Option: Selling as-is eliminates long timelines and financial uncertainties.

- Planning Is Essential: Whether rebuilding or selling, understanding your financial situation and consulting experts can lead to better outcomes.

Rebuilding vs. Selling As-Is: Pros and Cons

Pros of Rebuilding:

- Higher Resale Value: Rebuilding allows you to sell the property at market value, potentially recouping losses.

- Customization: You can design a home that fits modern trends and appeals to buyers.

- Insurance Coverage: If insured, rebuilding costs may be partially or fully covered.

Cons of Rebuilding:

- Costly: Rebuilding is expensive, especially without insurance coverage.

- Time-Consuming: It can take months or even years to complete, delaying financial recovery.

- Emotional Toll: Managing a construction project after a disaster can be stressful.

Pros of Selling As-Is:

- Immediate Cash: Selling to a cash buyer provides quick financial relief.

- No Repair Costs: Avoids the high costs associated with rebuilding or repairs.

- Fast Process: Closing can occur in as little as 7-14 days.

Cons of Selling As-Is:

- Lower Offer: Cash buyers often offer 60-80% of the post-damage value.

- No Future Appreciation: You lose the opportunity to benefit from potential market appreciation after rebuilding.

- Emotional Attachment: Letting go of a family home can be difficult.

Success Story: Moving Forward After a Wildfire

The Rodriguez family’s home in San Bernardino County was completely destroyed in a wildfire. Without insurance, they faced mounting financial pressure. By selling their fire-damaged property to a cash buyer, they received an offer within 48 hours and closed the sale in just 10 days. “It gave us the fresh start we desperately needed,” said Mrs. Rodriguez. “We couldn’t have asked for a smoother process.”

Frequently Asked Questions (FAQ) About Selling Fire-Damaged Properties

Q: Do cash buyers offer fair prices for fire-damaged homes? A: Cash buyers evaluate fire-damaged properties based on land value, location, and redevelopment potential. While offers may be below market value for undamaged homes, they provide a quick and hassle-free solution.

Q: What documents do I need to sell a fire-damaged property? A: Typically, you’ll need the property deed, disclosure forms about the damage, and any insurance claim documentation if applicable.

Q: How long does it take to sell to a cash buyer? A: Most cash sales close within 7-14 days, making it one of the fastest ways to sell a fire-damaged property.

Q: Should I repair my property before selling? A: Repairs can be costly, especially for fire damage. Selling as-is to a cash buyer eliminates this expense and reduces the stress of managing repairs.

Q: Are there cash buyers for uninsured fire-damaged homes? A: Yes, many cash buyers specialize in purchasing uninsured properties and base their offers on the property’s land value and redevelopment potential.

Q: How is the value of fire-damaged property calculated? A: The total value includes land value, salvageable materials, and any insurance payout. Cash buyers often offer 60-80% of this value for a quick sale.

Q: What’s the benefit of working with professionals for a quick sale? Professionals can connect you to cash buyers, provide expert guidance on pricing and staging, and ensure a smooth, efficient transaction process that saves you time and stress.

Disclaimer

This blog post is intended for informational purposes only and does not constitute legal, financial, or real estate advice. While we strive to provide accurate and up-to-date information, readers are encouraged to consult with licensed professionals regarding their unique circumstances. For advice tailored to your situation, contact a trusted real estate professional or legal advisor.